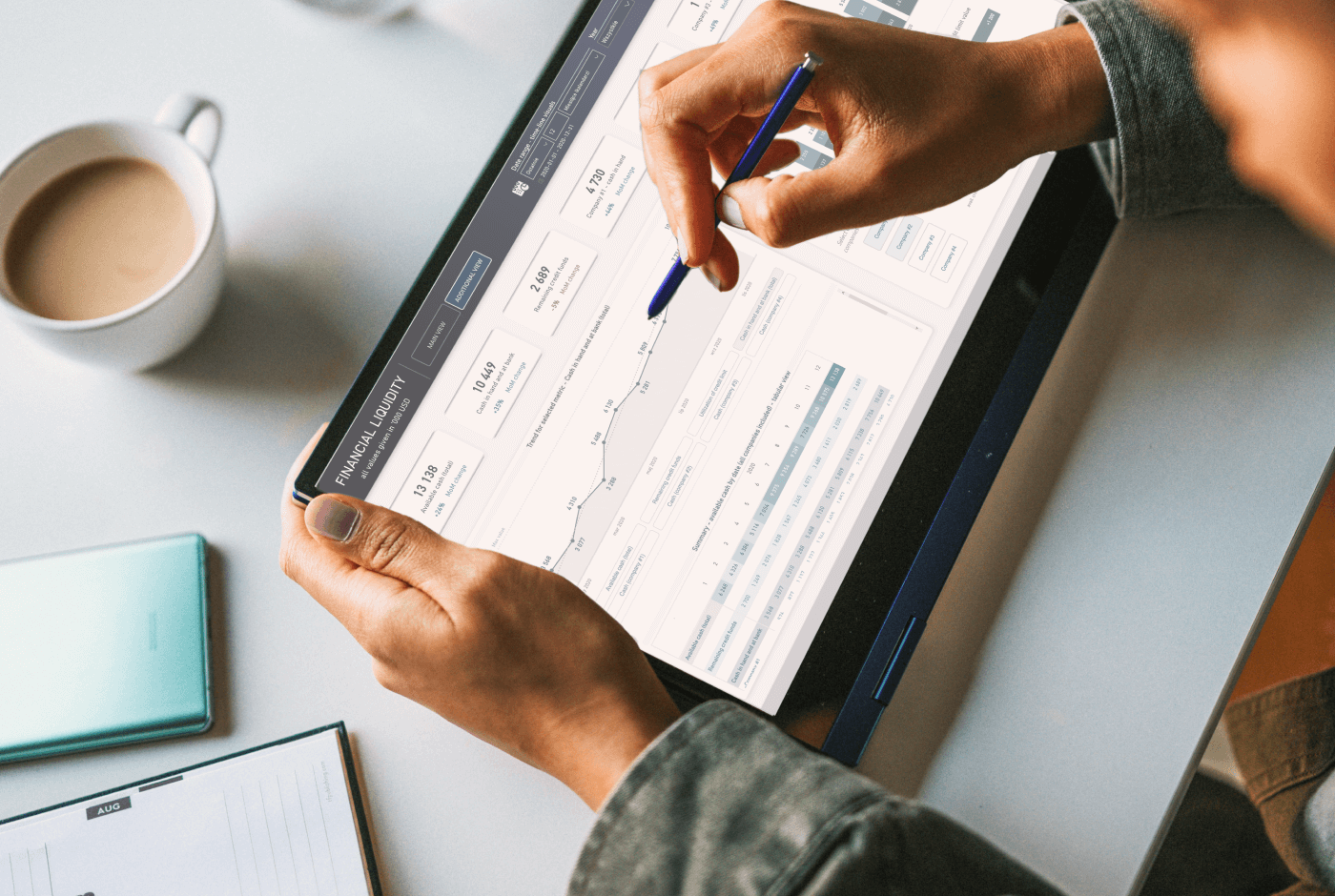

Controlling & strategic finance outsourcing

Comprehensive Financial Solutions to Drive Business Success

Drive business performance and achieve your objectives by implementing a strategically-oriented managerial accounting.

Transform your business into a truly data-driven organization through effective management based on accessible, complete and reliable data. Together we can ensure you stay ahead of the competition.

Expertise, knowledge, business value-oriented approach

For 15 years, we have been supporting ambitious managers and entrepreneurs in maximizing value by orchestrating and developing actionable business knowledge.

Our team consists of highly qualified, experienced and knowledgeable industry professionals that are passionate and dedicated to our clients.

We have streamlined management accounting, controlling procedures, budgeting and reporting in dozens of companies from almost every industry on 3 continents.

Our value

Benefits

It is essential for any company to know the mechanics and operations inside out. Understanding the overall health of your business can mean the difference between success and failure, and allow you to make timely changes if required.

Clean, organized data

Clean, organized data

Structured and cleaned data provides the foundation for any useful and reliable analysis. The role of management accounting, among others, is to harness the ocean of data and translate it into the language of the business. This is done by creation and supervision of the application of appropriate procedures and constant cooperation with data providers.

Increased efficiency

Increased efficiency

The main goal of managerial accounting is to improve the overall efficiency of business. Having obtained useful, complete and insightful reports, their recipients can take actions that will guarantee that all resources are utilized to their utmost potential. It plays an important part in increasing a company’s profitability, and it encourages organizations to be cost-conscious.

Goals and plans

Goals and plans

Effective budgeting and planning, along with continuous analysis of deviations, is one of the key functions of modern management accounting. Having well arranged data, a complete historical picture and a clear outlook, it will also be easier for you to define, track and benchmark against competitors the KPIs that build value for your business.

Enhanced decision making

Enhanced decision making

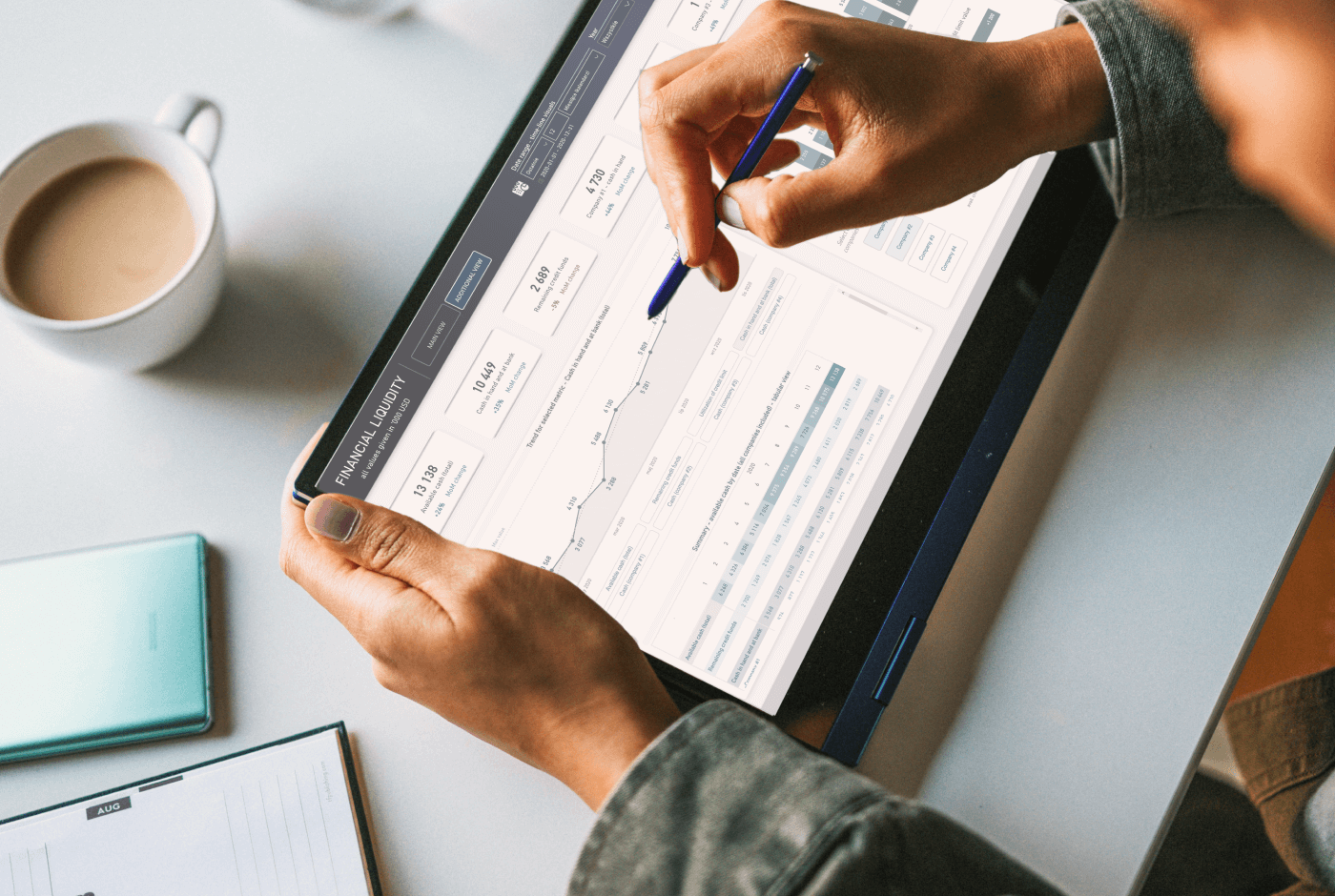

Management accounting uses information from your operations to create reports that provide ongoing insight into business performance, such as profit margin or labor utilization. As a result, you and your managers have data-driven input to make everyday decisions. In such circumstances, management accounting becomes an anchor of modern business.

Clean, organized data

Structured and cleaned data provides the foundation for any useful and reliable analysis. The role of management accounting, among others, is to harness the ocean of data and translate it into the language of the business. This is done by creation and supervision of the application of appropriate procedures and constant cooperation with data providers.

Increased efficiency

The main goal of managerial accounting is to improve the overall efficiency of business. Having obtained useful, complete and insightful reports, their recipients can take actions that will guarantee that all resources are utilized to their utmost potential. It plays an important part in increasing a company’s profitability, and it encourages organizations to be cost-conscious.

Goals and plans

Effective budgeting and planning, along with continuous analysis of deviations, is one of the key functions of modern management accounting. Having well arranged data, a complete historical picture and a clear outlook, it will also be easier for you to define, track and benchmark against competitors the KPIs that build value for your business.

Enhanced decision making

Management accounting uses information from your operations to create reports that provide ongoing insight into business performance, such as profit margin or labor utilization. As a result, you and your managers have data-driven input to make everyday decisions. In such circumstances, management accounting becomes an anchor of modern business.

Improve your management accounts and optimize your efficiency

Our offer

Whatever your financial and management accounting needs are, we can help you get results fast. We provide not only time and money savings, but also improve cash flow, operational health and provide far greater consistency.

1

Financial controlling

- Developing, implementing, and maintaining internal financial controls based on the best current practices and standards

- Support in shaping internal policies and procedures

- Customizing financial, accounting and operational data structures to meet business and reporting needs

- Automation of selected controlling and reporting processes

- Constant cooperation with accountants (internal & external), translation of accounting processes into business language and the other way around

- Monitoring the organization’s overall financial health

2

Budgeting & Forecasting

- Empowering organizations with tools & procedures that optimize planning processes

- Deployment of tools for detailed and transparent monitoring of ongoing plans fulfillment (incl. IBCS®-compliant presentation)

- Operational and strategic support in annual budgeting

- Rolling budgeting / mid-year forecasting assistance

- Support in cash flow analysis and forecasting

- Financial modeling for any business needs

3

Management Reporting

- Comprehensive design of an integrated reporting ecosystem for business management and informed decision-making

- Leveraging cutting edge BI technologies to create interactive, user-friendly reports

- Development of procedures and tools facilitating analysis of business profitability in various layouts, structures, business lines

- Support in analyzing financial and operational data and extracting business insights to inspire action

- Providing financial and strategic advice on financial month, quarter and year-end closing

- Reporting for investors, financial institutions and support during statutory audits or due diligence processes

4

Business Performance Measurement

- Developing meaningful KPIs

- Evaluating and improving existing KPIs

- Ensuring cascaded objectives and KPIs are aligned with strategy

- Improving communication and alignment around desired results

- Benchmarking against competitors

- Designing dashboards and reports to enable data-driven decision making

Our efforts are aimed at improving the efficiency of the business in every key segment

Cash Flow

We optimize the cash conversion cycle through well-organized analytical and budgeting processes.

Operations

We dive deeply into your business and support KPI-Driven Management to ensure ultimate operational efficiency.

Profitablity

We streamline procedures and provide tools to help you optimize your financial results.

Accounting

We work with your team and partners to ensure the timeliness and accuracy of all accounting and management reports.

We work transparently and we care about your trust

In case it’s your first time dealing with outsourcing in finance, please read the answers to questions that often arise at the beginning of the journey.

If you have any additional questions, don’t hesitate to reach out to us.

Am I obligated to a long-term contract?

Everything, of course, depends on the scope and scale of cooperation, but usually – no.

PWith long-term cooperation we act flexibly, you can terminate the contract with us keeping a short notice period of 1-3 months.

What kind of customers do you provide services to?

Throughout our several years of experience, we have served clients from every sector of the economy and countless business models. As a result, we find it easy to deliver added value to any type of business.

However, we have the most experience in serving clients in IT, Healthcare, Retail & E-Commerce, Recycling & CleanTech, Business Services, Packaging, Media & Publishing industries.

Am I assigned a dedicated representative for outsourced financial & controlling services?

PrWe assign you to a dedicated Manager who will work with you to understand your business’s unique needs. And, we can help your business no matter where you are located.

NOur day-to-day services are virtual, meaning we can connect with you via email, video conference, and/or phone.

Of course, if we jointly decide that there will be added value from physical meetings, we are always happy to visit your place of business.

What qualifications do your employees hold?

JesWe are a quite uniquely composed team of people with experience as a strategic advisor, CFO, financial controller, data analyst, database solution architect, BI-class reports developer.

This is extremely important, because with our holistic approach we provide added value at every stage of the creation of valuable management information.

How expensive are your services?

Certainly our services will cost you less than hiring a professional (or more than one) to cover the competencies you need.

Furthermore, we do not expect a company laptop, car, smartphone, fruity Thursdays and other benefits.

On top of that, the scope and thus the cost of working with us can scale as your organization’s needs grow. With us, you don’t have to hire a full-time analyst, financial controller or even a CFO right away.